Market Highlights: COOL Repeal Might Benefit Beef

By: Andrew P. Griffith, University of Tennessee

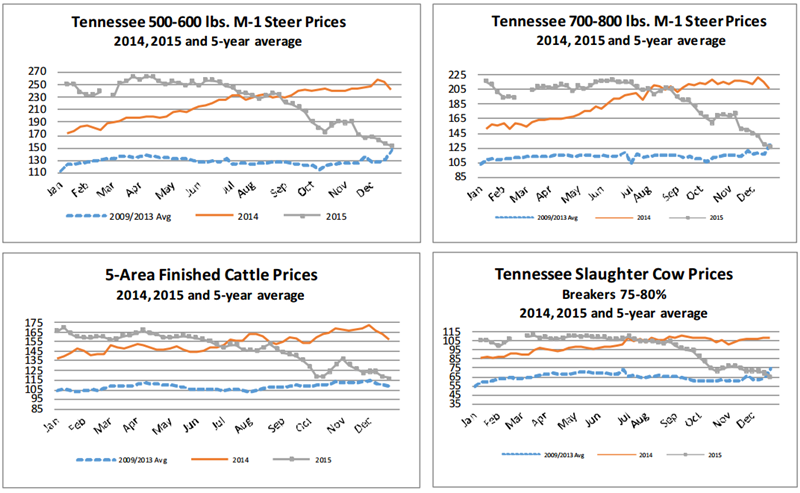

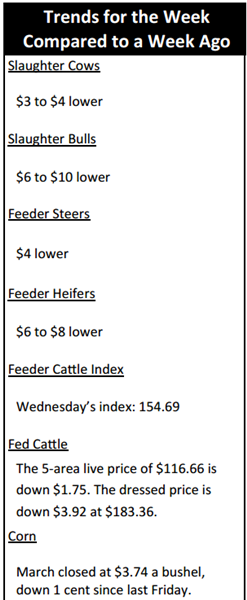

FED CATTLE: Fed cattle traded $1 to $2 lower on a live basis compared to a week ago. Live cattle trade was mainly $116 to $118 while dressed trade primarily ranged from $182 to $184. The 5-area weighted average prices thru Thursday were $116.66 live, down $1.75 from last week and $183.36 dressed, down $3.92 from a week ago. A year ago prices were $157.51 live and $249.92 dressed.

Finished cattle prices continue declining as wholesale beef prices continue to struggle. The one positive note for feedlots and finished cattle was the repeal of mandatory country of origin labeling which is likely the reason live cattle futures were up the limit on Friday. How much this news actually impacts the marketplace the next several weeks is yet to be determined, but its impact is not expected to change operations to any significant degree.

Feedlots are able to place cattle significantly cheaper than a year ago which has lowered break-evens, but the futures market is offering little help in terms of deferred contract prices to help feedlot managers hedge a profit. Margins continue to remain thin for cattle being purchased.

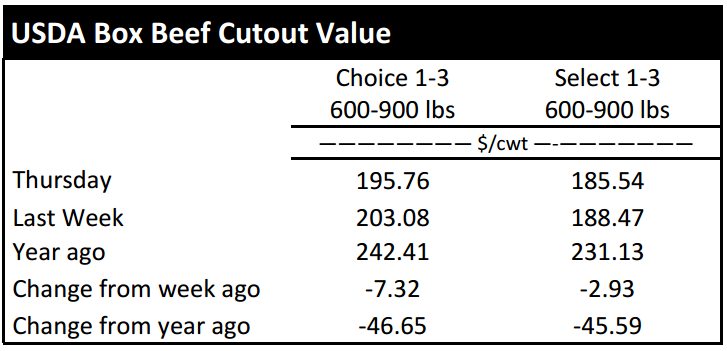

BEEF CUTOUT: At midday Friday, the Choice cutout was $194.63 down $1.13 from Thursday and down $8.74 from last Friday. The Select cutout was $186.69 up $1.15 from Thursday and down $1.76 from last Friday. The Choice Select spread was $7.94 compared to $14.60 a week ago.

It has been nearly two years, 102 weeks to be exact, since the Choice beef cutout price has been below the $200 mark, but that streak is now broken as Choice beef came under significant pressure this week. The retail sector continues to have strong margins as the retail price of beef continues to be elevated while wholesale prices continue to decline.

The All Fresh retail beef price for November was right at $6.00 per pound which is still 9 cents higher than November a year ago. The retail price of beef is slowly declining, but it will be a while before prices fall enough to coax consumers back to the beef counter. Relative to the retail price of pork and chicken, beef prices remain elevated and not the most attractive purchase.

It may continue to be unattractive to some as beef demand could be negatively impacted by the increase in interest rates. Consumers have only so much disposable income and now borrowing money is becoming more expensive which could result in cash strapped consumers spending those dollars elsewhere.

OUTLOOK: Cash prices reported for Tennessee auction markets have all classes of cattle lower this week with heifers taking the blunt of the blow. However, late week action in the futures market has feeder cattle trading up the limit on Friday.

Two significant pieces of information have hit the airways this week. One of those pieces of information was the Federal Reserve Bank announcing that they were raising interest rates 0.25 percent which places the interest rate at 0.5 percent. In general, increasing interest rates would weigh negatively on commodity markets as it makes it more expensive to borrow money. The futures market reflected some of this negative sentiment earlier in the week.

Alternatively, a more positive piece of information for meat protein markets came in the form of a repeal of country of origin labeling (COOL). U.S. legislators passed a bill repealing COOL which will help the cattle industry avoid retaliatory tariffs from Mexico and Canada. It is not fully known if this information is the reason for feeder cattle futures increasing the limit on Friday, but it is reasonable to think that it is the primary reason for the price rise.

It continues to look risky to use futures and options to hedge cattle at this point, but cash prices are yelling the word “Buy” right now. It is difficult to price a profit using futures on those cattle being purchased, but if seasonal trends and fundamentals related to limited feeder cattle supply kick in then a profit should be achievable in 150 days. It is very difficult and extremely risky to even begin trying to forecast where prices will be in a few weeks, much less three or four months from now.

The direction prices are headed may be a more achievable task and the outlook remains positive. There has not been any information that would suggest these prices should decline much more. However, there is a seasonal supply and demand pattern that would suggest prices will increase after the first of the year.

The December cattle on feed report for feedlots with a 1000 head or more capacity indicated cattle and calves on feed as of December 1, 2015 totaled 10.79 million head, 0.2% lower than a year ago, with the pre-report estimate average expecting an increase of 0.9%. November placements in feedlots totaled 1.60 million head, down 10.8% from a year ago with the pre-report estimate average expecting placements down 4.3%. November marketing’s totaled 1.53 million head up 3.9% from 2014 while the pre-report estimate expectation was up 3.0%. Placements on feed by weight: under 800 pounds down 13.1% and 800 pounds and over down 1.1%.

ASK ANDREW, TN THINK TANK: A few stocker producers have been asking if they should cut their losses and go ahead and market fall purchased calves or if they should continue to feed them. The answer depends on what they weigh and what the future marketing intentions are. For calves that were intended to be marketed in March or later then the suggestion would be to continue feeding those calves and look for opportunities to protect a price if need be. The answer in the short term is less certain as volatility remains high. There remains a good possibility that prices will begin slowly increasing after the first of the year.

Please send questions and comments to agriff14@utk.edu or send a letter to Andrew P. Griffith, University of Tennessee, 314B Morgan Hall, 2621 Morgan Circle, Knoxville, TN 37996.

FRIDAY’S FUTURES MARKET CLOSING PRICES: Friday’s closing prices were as follows: Live/fed cattle – December $120.15 3.00; February $125.53 3.00; April $127.18 3.00; Feeder cattle - January $148.75 4.50; March $147.95 4.50; April $148.68 4.50; May $149.43 4.50; March corn closed at $3.75 up $0.01 from Thursday.