After the Fire: Cattle Slaughter and Beef Prices

Cattle and beef markets continue to recover from the disruptions resulting from the Tyson packing plant fire in Finney County, Kansas on August 9. Data is slowly becoming available to provide more clarity to the aftermath of the fire and, in some cases, clear up some initial misperceptions. Lots of scrutiny and suspicions are being directed at cattle and beef markets.

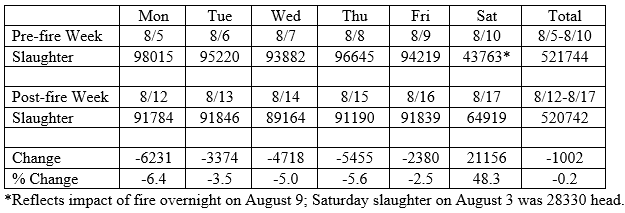

Actual slaughter data is available from the Agricultural Marketing Service with a two week lag. Thus, on August 29, data became available to compare the pre- and post-fire impact on cattle slaughter. Table 1 shows the actual daily steer and heifer slaughter for the week before and after the fire. Monday through Friday slaughter following the fire was down 22,158 head, 4.6 percent lower than the week before the fire. This reduction is close to the estimated capacity of the closed plant. However, by Saturday the industry was able to increase steer and heifer slaughter by 21,156 head compared to the previous week. This resulted in a net slaughter decrease of 1,002 head the week after the fire.

Numerous early media reports indicated that estimated slaughter the week after the fire was up by 9,000 head. This was incorrect largely because it included a large estimated increase in cow and bull slaughter and also because it was based on daily slaughter estimates. Actual slaughter data for the second week after the fire will be available later this week. The estimates currently available suggest that total steer and heifer slaughter two weeks after the fire may be up slightly compared to the week before the fire.

Table 1. Steer and heifer slaughter, head, USDA-AMS.

*Reflects impact of fire overnight on August 9; Saturday slaughter on August 3 was 28330 head.

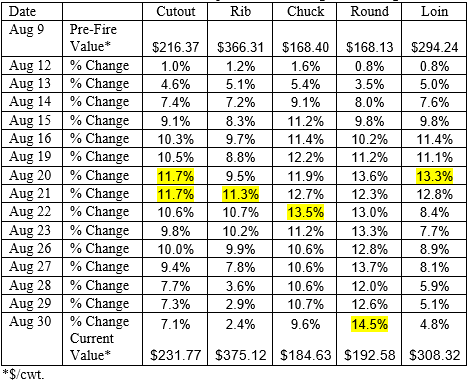

The reduction in beef production resulting from the fire provoked a sharp response in cash prices for boxed beef with varied responses for the different beef primals. Table 2 shows the price levels the day of the fire (the fire occurred after business hours) and the percent change in prices since that time. All percent changes in Table 2 are daily negotiated prices compared to values on August 9. The Choice cutout peaked on August 20 and 21, up 11.7 percent from August 9 levels. Cutout values have since decreased and are up 7.1 percent on August 30 compared to August 9.

In general, middle meat values spiked after the fire and have decreased sharply. Rib values peaked at 11.3 percent higher on August 21 and have dropped back to levels up 2.4 percent above pre-fire levels. Loin values peaked at 13.3 percent higher on August 20 and have dropped back to levels 4.8 percent above pre-fire levels by August 30.

End meats are sustaining higher levels since the fire. Chuck values peaked at 13.5 percent higher on August 22 and are still 9.6 percent higher on August 30. Round values have maintained sharply higher levels with the August 30 value the highest so far, up 14.5 percent from pre-fire levels. These patterns of value changes confirm the complexity of beef wholesale and retail markets and the product market contortions that have occurred as a result of the fire.

Table 2. Choice boxed beef and beef primal value changes since August 9.

Actual slaughter data now available also includes carcass weights before and after the fire. Steer and heifer carcass weights were each up three pounds in the week after the fire. There is no indication that possible slaughter delays pushed carcass weights higher as a result of the fire. Carcass weights have been increasing about three pounds per week since the early June seasonal low. Steer and heifer carcass weights were lower year over year for the week after the fire and are down 5+ pounds for the entire year thus far. Analysis of the fire aftermath will continue in the coming days and weeks.