Market Highlights: Grilling Season Could Boost Beef Prices

As the heat of spring and summer come grilling season looks to increase beef demand and prices.

By: Andrew P. Griffith, University of Tennessee

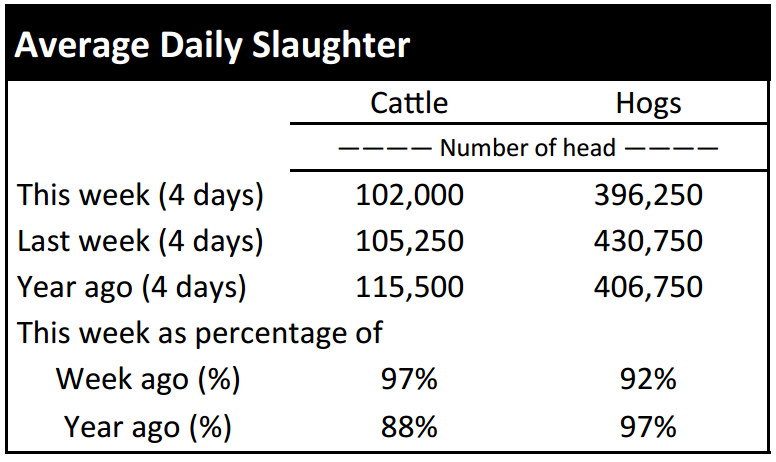

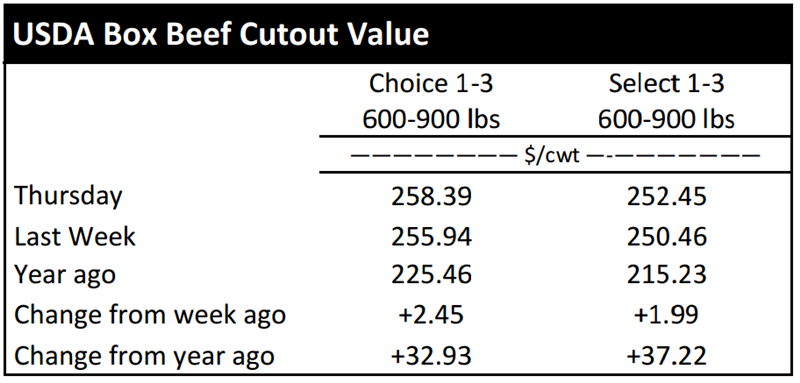

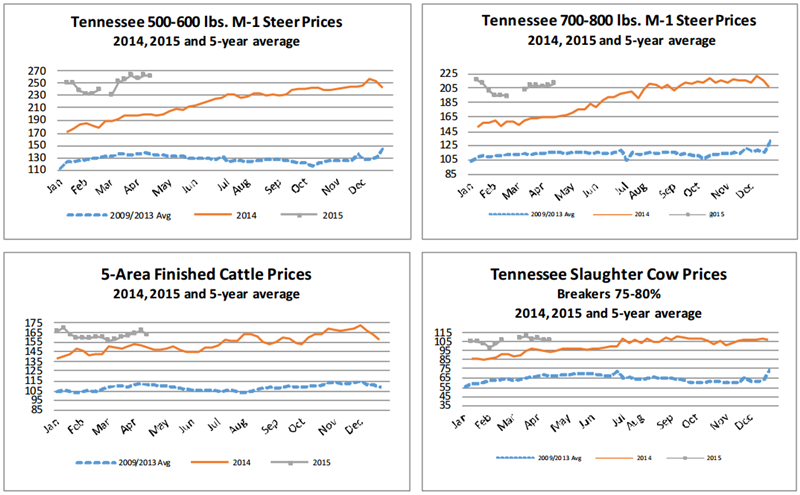

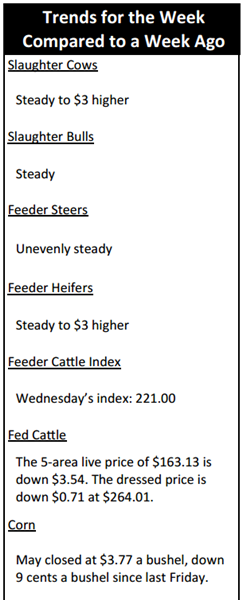

FED CATTLE: A few fed cattle traded $2 to $3 lower on a dressed basis. On a limited number of cattle, prices on a live basis were$163 to $165 while prices were between $263 and $265 on a dressed basis. The 5-area weighted average prices thru Thursday were $163.13 live, down $3.54 from last week and $264.01 dressed, down $0.71 from a week ago. A year ago prices were $149.32 live and $240.29 dressed.

Cattle feeders remain in the red on a cash-to-cash basis, and they continue to have higher ask prices for market ready inventory. The higher ask price is in complete contradiction with live cattle futures contract which declined this week and appears to have little support to slow the decline. Some may say this is the turning of the tide as far as leverage goes between the packer and the feeder.

However, cattle feeders should be able to maintain a bit of leverage until the number of market ready cattle seasonally increases this summer. Cattle feeders may be able to maintain a strong cash price relative to the futures price resulting in a strong basis figure which has been fairly common place the past several months.

BEEF CUTOUT: At midday Friday, the Choice cutout was $257.16 down $1.23 from Thursday and up $0.76 from last Friday. The Select cutout was $251.05 down $1.40 from Thursday and up $0.23 from last Friday. The Choice Select spread was $6.11 compared to $5.57 a week ago.

The beef market appears to be coming under fire even though cutout prices remain strong. Pork and chicken prices continue to retreat due to supply and demand factors which then also impact the price of beef. USDA increased pork production projections this month to 24.253 billion pounds for 2015 which is 1.395 billion more than one year ago. Broiler meat supply was unchanged from one month ago at 39.597 billion pounds, but it is projected to be 1.46 billion more pounds than one year ago.

Projected beef production is down 42 million pounds compared to one year ago. However, it is not only the supply side that is potentially problematic. All three protein markets are being somewhat hampered by weakness in the export market.

The beef industry will continue trying to capitalize on the spring beef market as grilling season heats up. Retailers and food service organizations generally have success moving beef during the grilling season, but a backup of other meat proteins and a subsequent price decline may result in some consumers making the switch to other meats.

TENNESSEE AUCTIONS: On Tennessee auctions this week compared to a week ago feeder steers and bulls were unevenly steady. Heifers were steady to $3 higher. Slaughter cows were steady to $3 higher while bulls were steady. Average receipts per sale were 664 head on 9 sales compared to 850 head on 10 sales last week and 617 head on 12 sales last year.

OUTLOOK: It appears spring calf marketings are slowing down as cattle producers are busy spraying and fertilizing pasture. It will only slow down further as hay harvest nears and as temperatures rise thru June and early July. Cow-calf producers who still have intentions of marketing calves this spring should keep a close eye on the market as lighter weight calf prices are expected to start a seasonal decline. Lightweight calf prices are expected to decline through the summer and into the fall of the year when spring born calves begin coming to market. From a buyer’s perspective, there are still some stocker producers and backgrounding operations that have not secured the desired spring inventory for summer grazing. It may be difficult for producers who are short on inventory to finish out their numbers as calf marketings decline. Moving through the summer, yearling cattle prices are expected to catch a spark which is a positive for fall calving herds that wean and background. Cattle weighing between 700 and 850 pounds are expected to follow a more seasonal pattern in 2015 and peak somewhere between late July and early September. This price movement may or may not be beneficial to producers who are using the futures market to hedge the sale of cattle. The August feeder cattle contract traded just shy of $236 per hundredweight in the middle of November and then dipped under $197 in the latter part of February. The August contract made a mini surge and fell just shy of $220 in the second half of March. The August contract lost another $5 per hundredweight from the end of March to April 9th, and it appeared the decline was going to continue through the end of the week. The 16.5 percent price swing from November through February demonstrates traders of feeder cattle futures are not sure where the market should be or where it is going. The 11.6 percent swing in prices from late February through March could have easily led to hedgers losing confidence in the futures market. Purveyors are now frantic but sitting stone faced trying to determine what the recent decline in prices mean.

TECHNICALLY SPEAKING: Based on Thursday’s closing prices, April live cattle closed at $161.80. Support is at $161.38, then $160.57. Resistance is at $162.18, then $162.98. The RSI is 60.48. June live cattle closed at $151.57. Support is at $151.03, then $150.03. Resistance is at $152.03 then $153.03. The RSI is 56.93. August live cattle closed at $148.68. Support is at $148.55, then $148.10. Resistance is at $149.05, then $150.10. The RSI is 56.21. April feeders closed at $216.48. Support is at $216.07, then $215.00. Resistance is at $217.15 then $218.22. The RSI is 56.41. May feeders closed at $213.70. Support is at $213.06, then $211.51. Resistance is at $214.61 then $216.16. The RSI is 53.21. August feeders closed at $215.03. Support is at $214.38, then $212.68. Resistance is at $216.30 then $217.75. The RSI is 53.07. Friday’s closing prices were as follows: Live/fed cattle – April $158.80 -3.00; June $148.80 -2.78; August $146.55 -2.13; Feeder cattle - April $212.45 -4.03; May $209.73 -3.98; August $211.45 -3.58; September $210.75 -3.78. May corn closed at $3.77 down $0.01 from Thursday.