Market Highlights: Football Tailgates Might Help Move Beef

By: Andrew P. Griffith, University of Tennessee

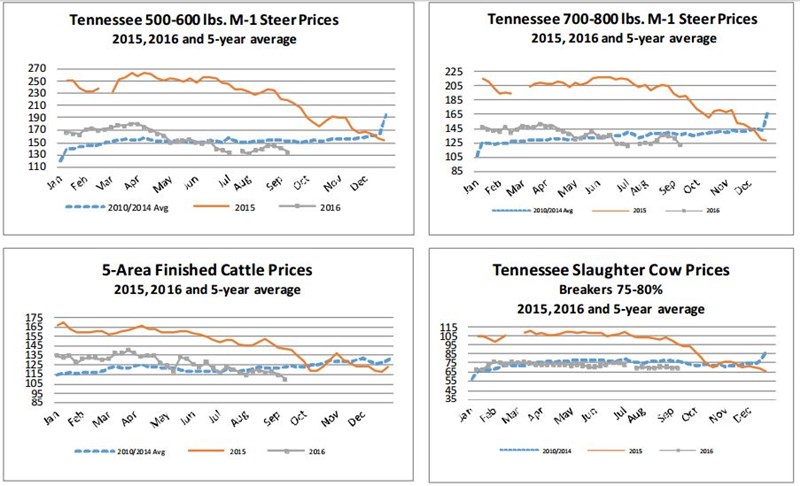

FED CATTLE: Fed cattle traded $5 lower on a live basis compared to last week. Live prices were mainly $110 while prices on a dressed basis ranged from $173 to $175. The 5-area weighted average prices thru Thursday were $109.92 live, down $4.89 from last week and $174.03 dressed, down $6.35 from a week ago. A year ago prices were $141.20 live and $222.12 dressed.

As live cattle future prices declined, cattle feeders were willing sellers early in the week. The $11 futures price decline over the past three weeks is digging deeper into the pockets of cattle feeders. Cattle feeders continue to write closeouts in red because fed cattle prices are declining quicker than costs. Futures prices have plowed through all of the support prices and continue to look for new contract lows.

Talking about lows, contracts for live cattle for June, August, and October of 2017 are trading under $100 per hundredweight which is the first time a live cattle contract has traded below $100 since November 17, 2010 when the December 2010 contract did so. Cattle feeders are hard pressed to find a positive to feeding cattle.

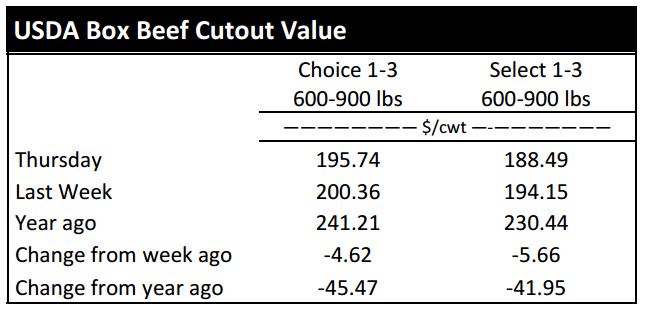

BEEF CUTOUT: At midday Friday, the Choice cutout was $192.10 down $3.64 from Thursday and down $7.63 from last Friday. The Select cutout was $187.92 down $0.57 from Thursday and down $6.12 from last Friday. The Choice Select spread was $4.18 compared to $5.70 a week ago.

The market sits and waits to see how much clearance of beef products occurs over the Labor Day weekend. Wholesale beef prices have been lackluster leading up to the last grilling holiday of the year, and now the only potential positive is if consumers raid grocery stores for beef which will mean grocers will have to make purchases to restock the shelves at the meat counter. There could be a little help from the start of football season as consumers grill for tailgating activities, but beef generally hits a time of reduced interest during the fall months.

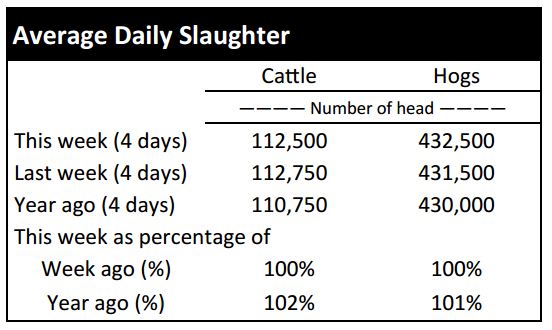

Steer slaughter year to date is 7.1 percent higher than the same time period last year and 0.2 percent higher than the five year average. Heifer slaughter in 2016 is 0.3 percent below the same time period last year, but has been higher than a year ago 10 of the last 11 weeks. The increased slaughter rate has led to an increased beef production of 5.1 percent year to date which has helped pressure prices. The increased slaughter is partially due to pulling cattle forward to capture positive basis which may limit cattle numbers this fall.

OUTLOOK: The perils of a commodity market strike again as calf and feeder cattle prices continue their steep decline. Based on Tennessee weekly auction averages, steers were $6 to $9 lower compared to a week ago while heifers were $5 to $7 lower than the previous week. No one should be surprised the feeder cattle market strengthened $10 to $15 per hundredweight in late July and early August and has now lost the biggest part of that gain through the back half of August.

Cattle markets have been extremely volatile for a couple of years now which seems to be the new normal. The market is now back in the trading range that it played in from the middle of June to the beginning of August. The most worrisome aspect is that downside pressure remains.

Calf prices will take the brunt of the blow as the fall calf run will soon be under way. As more and more calves make their way to town, calf prices will continue to decline. These declining prices will make it tough for many in the cow-calf business to be profitable. Based on the Tennessee weekly auction average, 525 pounds steers were worth $710 per head while same weight heifers averaged $640 per head. These revenue levels will more than likely cover variable expenses on most operations, but the revenues remaining after covering variable costs will likely fall short of covering fixed costs.

The story only gets worse if further price declines are factored into the equation. Calf prices could easily decline another $30 to $60 per head through October and November which is when most producers wean and market calves. Similar to calf prices, feeder cattle prices have waned and will continue to be pressured.

To speak lightly, this has been a bad year for stocker producers. Fall of 2015 calf purchases lost many dollars and calves purchased throughout 2016 have done well to break even. However, fall 2016 is a buyer’s year. With the expected decline in calf prices, financial risk is lower and feeder cattle prices should receive support in the beginning of 2017. There is no golden ticket in the business of growing cattle right now, but a few glimmers of light are seen in the darkness.

ASK ANDREW, TN THINK TANK: Earlier this week, I had the opportunity to listen to a Cattle Fax analyst provide a beef cattle outlook and risk management considerations presentation. The presentation was done well and some very good points were discussed. No one in the audience asked what cattle prices are going to do, because all indications are toward lower prices. What made me feel good about the presentation is that the presenter made the same comments I have been making to cow-calf producers. Those comments include: 1) producers need to determine where they can reduce costs because high profit producers are generally good cost managers, 2) find ways to add value to the cattle, and 3) make management decisions that result in utilizing resources to their highest value.

Please send questions and comments to agriff14@utk.edu or send a letter to Andrew P. Griffith, University of Tennessee, 314B Morgan Hall, 2621 Morgan Circle, Knoxville, TN 37996.

FRIDAY’S FUTURES MARKET CLOSING PRICES: Friday’s closing prices were as follows: Live/fed cattle – October $101.60 -1.98; December $103.48 -1.93; February $104.25 -1.73;Feeder cattle – September $134.88 -2.43; October $132.08 -2.45; November $129.68 -2.08; January $125.08 -1.80; September corn closed at $3.16 up $0.06 from Thursday.