Market Highlights: Feeder Market Cooling

The cash feeder cattle market has cooled considerably the past month and a half as has the futures market.

By: Andrew P. Griffith, University of Tennessee

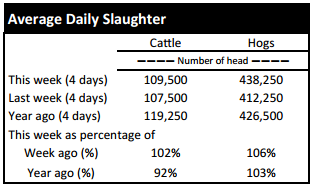

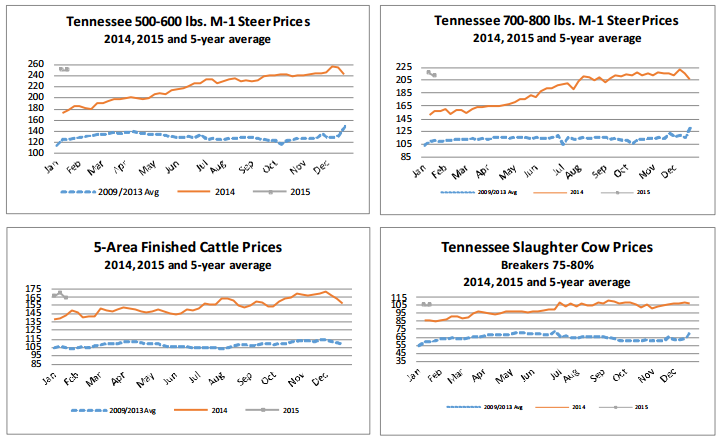

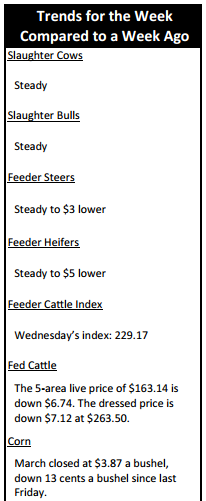

FED CATTLE: Fed cattle traded $6 to $7 lower on a live basis compared to a week ago. Prices were mainly $163 to $164 on a live basis while dressed trade ranged from $260 to $265. The 5-area weighted average prices thru Thursday were $163.14 live, down $6.74 from last week and $263.50 dressed, down $7.12 from a week ago. A year ago prices were $142.45 live and $227.27 dressed.

The fed cattle market has started to deteriorate after surging the past couple of weeks. This decline should come as no surprise to market participants as fed cattle prices generally soften in January and February before strengthening again in early spring.

Though prices have softened this week, prices remain $20 per hundredweight higher on a live basis compared to the same week a year ago while dressed prices are about $36 per hundredweight higher than the same time last year. Additionally, cash fed cattle prices continue to trade at about a $9 premium to live cattle futures.

This is a very strong basis for this time of year, and it is actually a rather strong basis for anytime of the year. Feedlot managers may be reeling from the decline in prices, but they may just be very fortunate that prices are maintaining the current level.

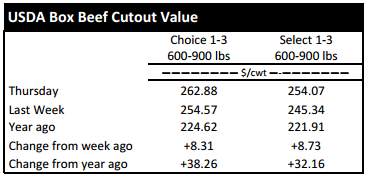

BEEF CUTOUT: At midday Friday, the Choice cutout was $261.13 down $1.75 from Thursday and up $4.74 from last Friday. The Select cutout was $252.20 down $1.87 from Thursday and up $4.62 from last Friday. The Choice Select spread was $8.93 compared to $8.82 a week ago. Choice and Select cutout prices are not far from record prices set in early August of 2014.

The increase in cutout prices coupled with declines in fed cattle prices this week released significant pressure on margins. Many packing operations have been seeing red ink for several months as fed cattle prices continued to escalate and boxed beef prices met resistance. However, this week fed cattle prices were forced down while packers were able to move boxed beef at higher prices.

Packers are not out of the woods just yet as beef prices will continue to be pressured as the retail price of beef escalates and as the strength of the US dollar will make it ever more difficult for exports in the near term. One benefit in relation to the export market is the reduced supply of beef globally. It is not just US herds that have been hit by drought but also Mexican herds and Australian herds. Thus, US beef will be able to remain competitive to some extent on the global market.

TENNESSEE AUCTIONS: On Tennessee auctions this week compared to last week steers and bulls were steady to $3 lower. Heifers were steady to $5 lower. Slaughter cows and slaughter bulls were called steady. Average receipts per sale were 598 head on 12 sales compared to 600 head on 12 sales last week and 900 head on 12 sales last year.

OUTLOOK: The cash feeder cattle market has cooled considerably the past month and a half as has the futures market. Some producers feel some cause for concern as they watch prices dip, but it may mean the futures market will be able to find a more steady state and not be subject to so much volatility. The violent price swings the past several months in the futures market has made it nearly impossible for producers to effectively manage price risk at any level of production. A less volatile market may provide producers the opportunity to use futures, options, or livestock risk protection to manage price risk at a relatively inexpensive cost compared to the cost of managing price risk the past several months. Though market prices have declined, cow-calf producers and stocker producers continue to be in a profitable situation. Prices remain at levels in which producers can profit between $400 and $500 per head in 2015. The current weekly auction average price for 550 pound steers was $250 per hundredweight which is $75 per hundredweight higher than the same week a year ago or $413 per head more than last year. Similarly, 550 pound heifers are trading for $65 per hundredweight more than the same week a year ago which is $358 more per head. The slip in the market does not appear to be a weakening market. It is more likely the change in market prices is a correction because cattle in late November and early December where slightly overvalued. The market is still likely to see a flare as we move into grass fever months, but in all likelihood such a flare will be small relative to most years. Feeder cattle futures prices should have the ability to sustain themselves above the $200 per hundredweight mark as there appears to be strong support at those levels. As long as futures sustain themselves so will the local cash market. The one benefit to prices falling is to stocker producers and their current purchase of cattle. The drop in prices reduces the overall investment in cattle and thus the capital needs to secure inventory. Market participants should be looking for prices to stabilize, but managing price risk should also be considered.

TECHNICALLY SPEAKING: Based on Thursday’s closing prices, February live cattle closed at $154.20. Support is at $153.08, then $150.03. Resistance is at $156.13, then $159.18. The RSI is 29.11. April live cattle closed at $152.80. Support is at $151.57, then $148.52. Resistance is at $154.62, then $157.67. The RSI is 28.70. June live cattle closed at $146.45. Support is at $146.00, then $145.00. Resistance is at $147.60 then $148.10. The RSI is 31.18. January feeders closed at $215.65. Support is at $213.97, then $208.95. Resistance is at $219.00 then $224.03. The RSI is 36.02. March feeders closed at $205.60. Support is at $203.98, then $199.13. Resistance is at $208.83, then $213.68. The RSI is 29.87. April feeders closed at $206.35. Support is at $205.50, then $204.90. Resistance is at $210.58 then $211.48. The RSI is 34.93. Friday’s closing prices were as follows: Live/fed cattle –February $154.45 0.25; April $152.95 0.15; June $146.48 0.03; Feeder cattle - January $214.10 -1.55; March $204.85 -0.75; April $206.45 0.10; May $207.33 0.18. March corn closed at $3.87 up $0.07 from Thursday.