Market Highlights: Consumers Want Beef

Consumers talk with their disposable income, and the consumer continues to display their preference for beef.

By: Andrew P. Griffith, University of Tennessee

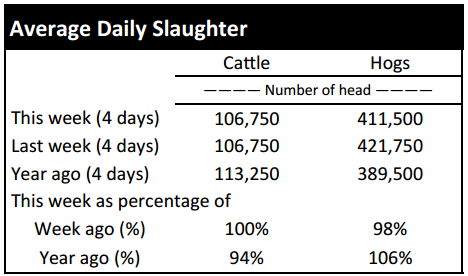

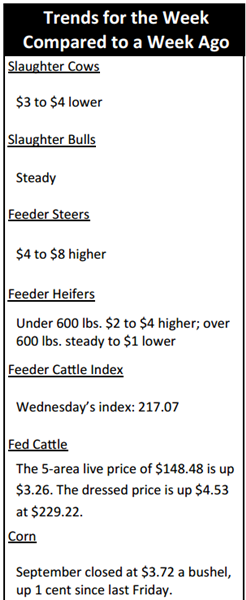

FED CATTLE: Fed cattle trade was not well established at press. Asking prices were firm at $152 on a live basis and $240 on a dressed basis. The 5-area weighted average prices thru Thursday were $148.48 live, up $3.26 from last week and $233.75 dressed, up $4.53 from a week ago. A year ago prices were $160.75 live and $253.47 dressed.

It would appear the fed cattle market has already put in its summer low. The fed market is now expected to slowly creep up the ladder the next couple of months before being fueled in the fall by the end of year holidays. Prices are not expected to race to year ago levels nor are prices expected to reach year ago record prices.

One of the struggles fed cattle prices will encounter this fall and winter is the expectation of increased placements in the feedlot. Feedlot placements are expected to increase this fall which will result in strong beef production a few months down the road which will keep packers buying hand to mouth for immediate need as they wait for the opportunity to grab some leverage from cattle feeders.

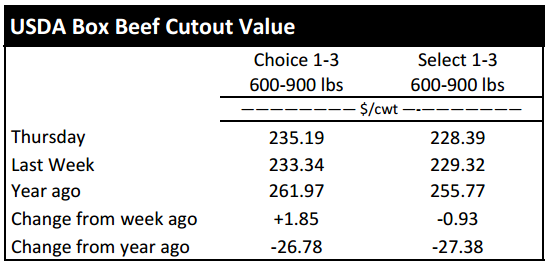

BEEF CUTOUT: At midday Friday, the Choice cutout was $235.47 up $0.28 from Thursday and up $2.20 from last Friday. The Select cutout was $229.69 up $0.75 from Thursday and down $0.55 from last Friday. The Choice Select spread was $6.33 compared to $3.58 a week ago.

The beef cutout has finally found some support after declining to levels that many would say where the summer lows for boxed beef. Consumers continue to face record high retail beef prices, but they have also put their money where their mouth is and that is on a hamburger or steak.

Consumers talk with their disposable income, and the consumer continues to display their preference for beef. It is not only domestic consumers that like beef but also the international market. Though beef has found it difficult to match much less exceed year ago beef exports in total volume and value, June export data appears to be positive relative to the previous few months.

Canada continues to be the United States’ leading export market in both volume and value with 12,433 metric tons of beef worth more than $108 million in June. The aforementioned values represent a 6.7 and 9.1 percent decrease in value and volume respectively compared to a year ago. Japan, South Korea, Mexico, and Hong Kong round out the top five U.S. beef export markets.

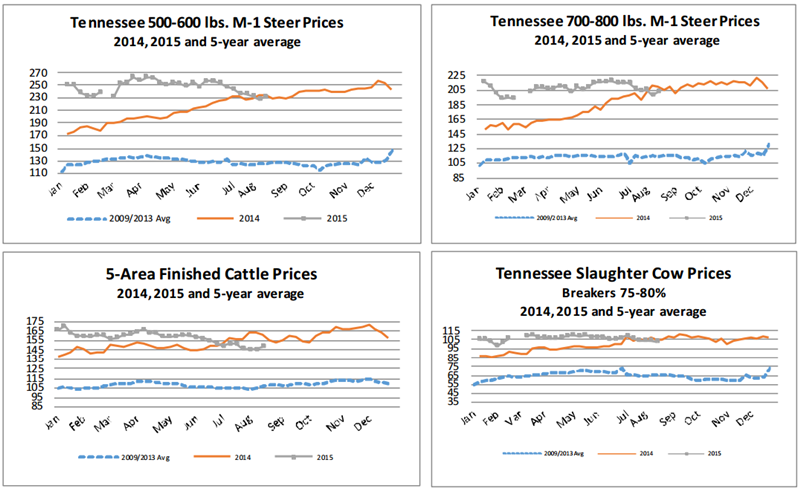

OUTLOOK: The calf market has been successful holding its ground this summer. However, the calf market will undoubtedly begin to wane as spring born calves begin coming to market the next several months.

Alternatively, the feeder cattle market is just now starting to warm up. The feeder cattle market had a rough go of it from the middle of June through the fourth week of July before experiencing a slight resurgence the past couple of weeks. A rough go of it for feeder cattle is relative to prices experienced the previous month as well as prices currently being paid by the feedlot.

The strengthening in beef cutout prices, fed cattle prices and feeder cattle futures has provided a little fuel to the feeder cattle market and may continue to do so the next several weeks.

Regardless of what packers and feeders try to do the next couple of years, cow-calf producers will remain in the driver’s seat of the cattle market. Cow-calf producers will be the folks who decide how large to grow the cattle herd and how quickly to do it.

There will be price signals that dictate beef cattle herd growth, but the current market continues to signal the need for beef cow inventory growth. The cow-calf producer will not know how many beef cattle are needed until the market price for calves and feeder cattle starts to erode in the coming years. Pretty much all data, including cow slaughter, heifer slaughter and cattle inventory, are pointing towards fairly rapid growth in the beef cattle herd.

How long such a rapid pace will persist is unknown, but it is important to remind producers retaining heifers and those purchasing heifers that the price of calves and feeder cattle will begin to erode in coming years when those heifers will be in peak production. The beef industry is likely looking at several more years of herd expansion. As the herd expands, leverage will shift from the cow-calf producer and work its way through the industry until the consumer shows a signal related to beef that will result in cattle producers reducing inventory.

ASK ANDREW, TN THINK TANK: A question was asked this week by Troy in Dickson County concerning the beef budgets that were developed in the Department of Agricultural and Resource Economics at the University of Tennessee. The specific question does not necessarily pertain to a large number of producers. However, it appeared to be a good time to remind people that beef budgets are available on our Budgets page. Cow-calf and stocker budgets are available in Excel and PDF formats. Additionally, it seems like a good time to remind people how enterprise budgets can be used. The first thing to remember is that a budget is a snapshot of a time period. A budget’s best use is generally for planning future production because it is helpful in allocating land, labor and capital to their most appropriate use given current information. The information a budget provides can be very limiting since market conditions and input costs can change rapidly. Additionally, a budget is only as good as the information used to create the budget. It is important that all expected revenues and all expected costs are represented in the budget to determine an expected return.

Please send questions and comments to agriff14@utk.edu or send a letter to Andrew P. Griffith, University of Tennessee, 314B Morgan Hall, 2621 Morgan Circle, Knoxville, TN 37996.

FRIDAY’S FUTURES MARKET CLOSING PRICES: Friday’s closing prices were as follows: Live/fed cattle –August $149.65 -0.08; October $148.40 -0.45; December $149.93 -0.30; Feeder cattle - August $214.03 -0.95; September $210.13 -1.35; October $207.68 -1.43; November $205.58 -1.55; September corn closed at $3.73 up $0.03 from Thursday.