Market Highlights: Cattle Futures and Beef Down

By: Andrew P. Griffith, University of Tennessee

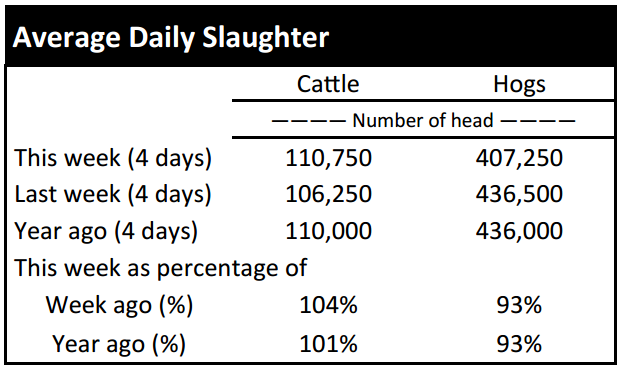

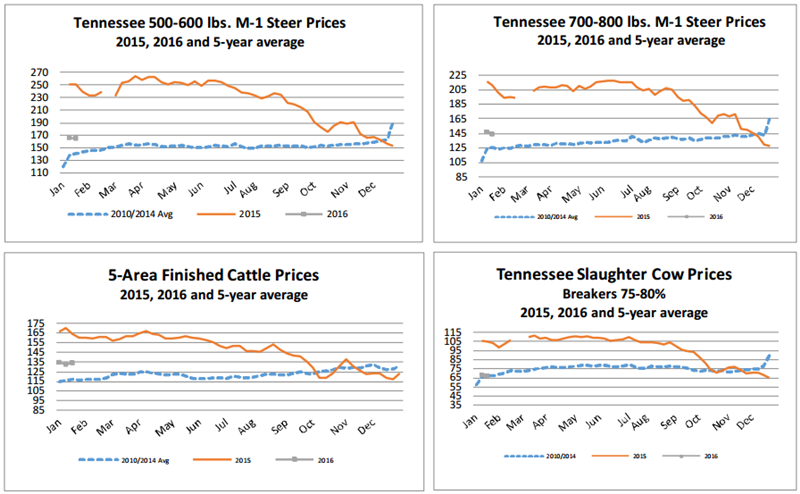

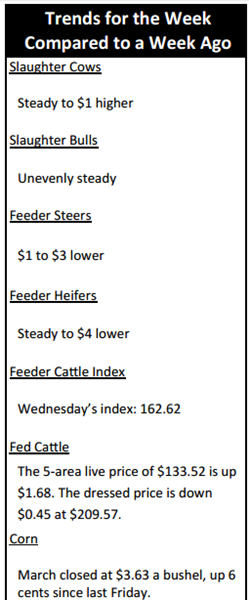

FED CATTLE: Fed cattle traded steady to $2 higher on a live basis compared to a week ago. Live cattle trade was mainly $132 to $134 while dressed trade primarily ranged from $208 to $210. The 5-area weighted average prices thru Thursday were $133.52 live, up $1.68 from last week and $209.57 dressed, down $0.45 from a week ago. A year ago prices were $163.14 live and $263.50 dressed.

Fed cattle traded firmer this week, but the futures market faltered late in the week which essentially put a halt to cattle trade. There is some indication that prices could fall further in coming weeks as the market is approaching a time of year where beef demand is slack compared to other times of the year.

Feedlot managers will likely continue holding out for higher prices in coming weeks. However, it is likely they will be more willing to let go of them than they were in the fall of 2015, because they do not want to weather a similar storm as was brought on just a few months ago by heavy cattle.

The one upside for cattle feeders is the reduced cost of replacement cattle relative to 2014 and the front half of 2015.

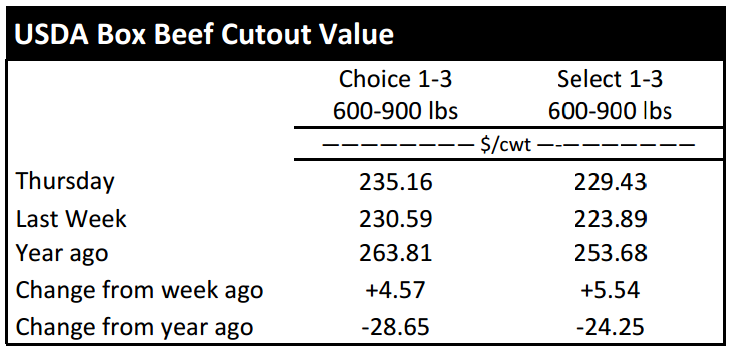

BEEF CUTOUT: At midday Friday, the Choice cutout was $232.65 down $2.51 from Thursday and up $1.42 from last Friday. The Select cutout was $227.63 down $1.80 from Thursday and up $3.04 from last Friday. The Choice Select spread was $5.02 compared to $6.64 a week ago.

Beef cutout prices continued to press forward most of the week compared to the previous week but slowed on Friday. The Choice Select spread has continued to narrow as is the seasonal tendency. During winter months, end meats begin garnering more attention than middle meats and the demand for Choice beef compared to Select beef is not as prevalent due to the method most end meats are prepared.

The expectation is for the beef cutout to falter to some degree the next several weeks, but the degree of decline is difficult to predict. There were probably not many in the industry that expected the wholesale price of beef to escalate like it has the past several weeks, but yet it escalated rapidly. If prices can go up that quickly then they can come down quicker as “gravity” always has a way of putting downward force on the market.

There are factors such as fuel price that are positive to consumers’ disposable income. It is often thought to benefit beef demand, but it is not easily recognizable in today’s market as other factors push the opposite direction.

OUTLOOK: Most classes of cattle traded steady to softer on Tennessee weekly auctions compared to one week ago.

Slaughter cows were the only class of cattle that showed much sign of stronger prices. Seasonally speaking, slaughter cow prices generally begin to slowly increase in the winter months and then find their strongest support through the spring months before tapering off during the summer and fall time periods.

There is no reason for the market to expect a deviation from the seasonal tendency at this time for slaughter cows so producers are encouraged to plan accordingly. While slaughter cows are holding their own, the feeder cattle market continues to work through trying times.

The end of 2015 and beginning of 2016 brought strengthening prices from the feeder cattle side of the market. However, the past ten days have not been so generous as the January feeder cattle futures price declined $14 over that time period. There is some concern by industry professionals and analysts that the feeder cattle market trade is far removed from the fundamentals in the market.

Feeder cattle futures are very thinly traded relative to many of the other futures contracts being traded which can induce increased volatility and make hedging difficult. In other words, there are not a lot of contracts being traded and one or two entities trading large numbers of contracts can shift the price and the shift may not have anything to do with cattle market fundamentals.

This is a situation where potential hedgers should remain cautious when utilizing the futures market to hedge the purchase and sale of feeder cattle. Aside from the futures market and fundamentally speaking, the calf market is not too far away from a seasonal increase in prices.

It may only be the middle of January, but it is not too early to begin considering the March and April calf market. Calves will be in high demand by grass based stocker operations by March and April.

Cow-calf producers should be considering management decisions and marketing alternatives to maximize the value of the animal while stocker producers should be running breakeven and target profit numbers.

ASK ANDREW, TN THINK TANK: As human beings, we often try to control every aspect of life. As agricultural producers, we realize there are very few things we have control over. The prime example of not having control is Mother Nature. Similar to other agricultural production, cattle producers have little to no control over prices. Thus, cattle prices cannot be controlled but they can be managed and risk reduced. The one thing cattle producers can closely manage and impact profits the most is cost of production. As cattle prices continue to erode the next several years, cattle producers need to take a close look at cost of production to see where wasteful spending is occurring. Managing cost of production could mean the difference in profits and losses.

Please send questions and comments to agriff14@utk.edu or send a letter to Andrew P. Griffith, University of Tennessee, 314B Morgan Hall, 2621 Morgan Circle, Knoxville, TN 37996.

FRIDAY’S FUTURES MARKET CLOSING PRICES: Friday’s closing prices were as follows: Live/fed cattle –February $127.58 -2.98; April $128.50 -3.00; June $119.80 -2.93; Feeder cattle - January $154.30 -4.50; March $150.28 -4.50; April $150.85 -4.50; May $150.70 -4.50; March corn closed at $3.63 up $0.05 from Thursday.